John Dorfman Columns category, Page 2

Watch the surge of insider buying at UnitedHealth Group

You might think UnitedHealth Group Inc. (UNH) would be on the ropes. One of its top executives was shot dead, its CEO resigned for personal reasons and the federal government is probing its billing practices. But executives at this health insurance and health services giant apparently don’t think doom is...

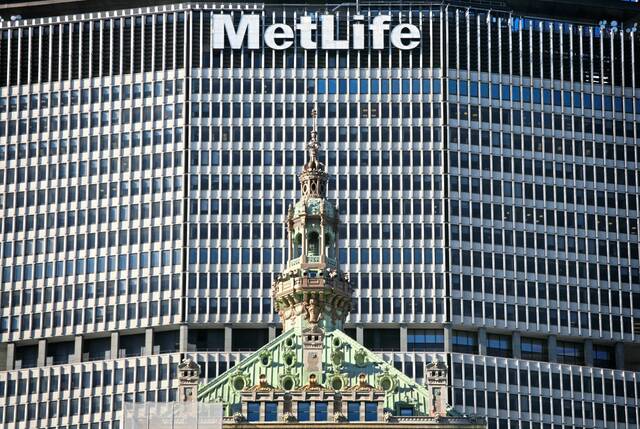

John Dorfman: Financial stocks have topped charts for past year

The best performing sector in the stock market for the past year has been the unsung financial sector. Its 24% return through May 31 was nearly double the return on the market as a whole. Unlike technology or biotech, financial stocks don’t get people very excited. There’s no tantalizing hint...

John Dorfman: Why I’ll continue to invest in gold, at least for another year

About 14 months ago, I wrote a column about gold. “I don’t think gold is an investment for all seasons,” I wrote, “but right now, I think it’s sensible to hold some.” That turned out to be right. Gold is up about 51% since I made that recommendation, including a...

John Dorfman: 5 companies that consistently buy back their own shares

When a company buys back its own shares, shareholders often benefit. With fewer shares outstanding, each share is likely to be worth more. In the past 20 years, buybacks have become increasingly popular. Many companies prefer them to dividends because they have a softer tax impact. Dividends stick shareholders with...

Molson Coors and Cigna Head My “Do Nothing” Stock List

You probably wouldn’t bet on a horse that usually finishes in the middle of the pack. But, in the stock market, sometimes that’s a good idea. Once a year, I write about my “Do Nothing Club,” a group of stocks that linger near their prices from a year ago but...

John Dorfman: Contestant rides Palantir’s 446% gain to stock derby win

A 446% gain in Palantir Technologies Inc. (PLTR) propelled Christy Anderson to a victory in the 2024-25 running of Dorfman’s Three-Stock Derby, an annual stock-picking contest. Anderson of Las Vegas is chief operating officer of a small company that makes radio frequency amplifiers with military applications. As such, she became...

John Dorfman: Old Faithful fizzled last year, but watch for a spurt

One of my favorite tools for picking stocks is a paradigm I call Old Faithful, named after the geyser in Yellowstone Park. This paradigm fizzled last year but has an outstanding long-term record. To appear on the Old Faithful list, a stock must: • Post good profits (15% return on...

John Dorfman: Netflix, Crocs, 19 other stocks make 30-30 Club

In today’s tumultuous market climate, it’s hard to know what stocks to hold. But the stocks of outstanding companies always deserve a look. Consider the members of my 30-30 Club. In baseball, the 30-30 Club includes players who hit 30 home runs and steal 30 bases in a year. My...

John Dorfman: Tariff steamroller has flattened some good stocks

The tariff steamroller ran over the stocks of some good companies in the first quarter and early April. That provides lots of candidates for my Casualty List, a roster of stocks that have been hit hard and that I believe have excellent recovery potential. The basic idea in investing is...

John Dorfman: Go off the beaten path with mid-cap stocks

You’re probably hearing a lot — much of it malarkey — about how to position your investment portfolio in an age of tariffs and trade wars. One piece of advice you may hear, which at least makes some sense, is that mid-capitalization stocks are less dependent on foreign suppliers and...

John Dorfman: 5 foreign stocks worth considering as U.S. market lags

This year through March 21, stocks were up 9% in France, 15% in Germany and 18% in Hong Kong. In the U.S., stocks were down 3%. A little international diversification might be a good idea, especially with U.S. stocks currently on the expensive side. Yet many American investors have 100%...

John Dorfman: On Nasdaq, less-famous stocks look intriguing

The Nasdaq Stock Market led the way up in the great rally of the past two years. Now it’s leading the way down. Nasdaq is home to most big technology stocks and many small stocks. The Nasdaq Composite Total Return Index gained more than 44% in 2023 and more than...

John Dorfman: CEOs at 197 companies made big stock sales lately

Company insiders are ditching their own stock more than usual. An exception is oil and gas executives, some of whom are buying while their shares are depressed. To gauge insider sentiment, look at the ratio of buys to sells by top executives and large shareholders. According to Gurufocus.com, about 34%...

John Dorfman: Want to predict the economy? Well, then enter my derby

Terry Johnson, the winner of my Derby of Economic Forecasting Talent (DEFT) for 2024, likes to count trucks. Specifically, he counts the number of big rigs — 18-wheelers and the like — on a 45-mile stretch between Lincoln and York, Neb. More trucks means the economy is doing well. Fewer...

John Dorfman: How to make a terrible stock market bet

There are no sure ways to win in the stock market. But here’s a fairly sure way to lose: Invest in a stock that sells for 100 times revenue or more. The price/sales ratio for General Motors is less than one, for McDonald’s Corp. about 9, and for Microsoft about...

John Dorfman: 5 Balance Sheet Powerhouses I recommend

“Winning isn’t everything. It’s the only thing,” said football coach Vince Lombardi years ago. Many investors feel the same way about earnings. Excuse me, Lombardi disciples, but earnings aren’t the only thing. To withstand unexpected hardships or to seize timely opportunities, a company’s financial strength is also key. Once a...

John Dorfman: Bank of New York Mellon and Fox show value, momentum

Last year, momentum stocks were up 46%, growth stocks 36% and value stocks only 12%. As a longtime value investor, I find those figures (from S&P Dow Jones Indices) discouraging, yet also instructive. Let’s define our terms: • Momentum stocks are rising in price faster than the overall market. •...

John Dorfman: 6 cheap stocks with great 5-year returns

For years, my mentor, David Dreman, invested in Westinghouse Electric Co. The stock was cheap, often selling for about nine times the company’s per-share earnings. The stock price marched up nicely, yet the stock stayed cheap, because earnings were rising as fast as the stock price. That’s a value investor’s...

John Dorfman: Can analysts pick stocks? I doubt it

Can professional analysts pick stocks? Don’t laugh. Analysts perform many valuable functions. They ask probing questions of management, estimate earnings and provide a wealth of information on companies and industries. However, a study I’ve been conducting for a quarter of a century suggests they are no better at picking stocks...

John Dorfman: Robot Portfolio gained 22% in 2024

The Robot Portfolio returned more than 22% last year but was edged out by the surging Standard & Poor’s 500. Each year, the Robot — a naive stock-picking paradigm — generates a theoretical portfolio of 10 very unpopular stocks. The idea is that stocks advance by exceeding expectations, and low...

John Dorfman: Bosses are buying at these 4 companies

Chief executives probably know their companies better than anyone else. So when the boss is buying his company’s stock, it’s wise to pay attention. Here are four stocks I think deserve a look. In each case, the chief executive officer (CEO) has made a significant purchase in the past few...

John Dorfman: Pfizer, Schlumberger are January Bounce candidates

Stocks that struggle during the first 10 months of the year often fall further during November and December, as some investors sell to realize a tax loss. Once the tax-motivated selling subsides, such stocks frequently bounce back in January. Each year, I offer a few January bounce candidates — ones...

John Dorfman: Here’s another stock picking tool for your kit

Here’s a stock picking tool you might not have thought about. It’s called the PEG ratio. The PEG ratio is a ratio of two ratios. The numerator, or top line, is a stock’s price/earnings ratio, expressed simply as a number. This is the stock’s price divided by per-share earnings. If...

Citizens and Molson Coors look good based on book value

Stocks that are cheap relative to book value appeal to me a great deal. What’s book value? It’s basically a company’s net worth — its assets minus its liabilities. The figure is often expressed per share of common stock. General Motors Co. (GM), for example, has a book value of...

John Dorfman: These 5 stocks are hedge-fund faves

Many of this country’s most talented stock pickers choose to work at hedge funds, where salaries and bonuses often are more attractive than at bank trust departments or mutual funds. Gurufocus.com publishes a screen of stocks that are popular with leading hedge funds. For this column, I took that screen...