Almost two years ago, Carol Sepesky’s computer went black.

The only thing the Monessen resident could see was a message, supposedly from Microsoft, asking her to call customer support. So she did, and paid $600 to someone posing as a company representative to fix her computer.

When they asked for another $3,000, her son recognized the scam and stepped in.

“I didn’t think it was suspicious because I thought they were going to protect my computer,” said Sepesky, 82. “It was shortly after my husband died, and I wasn’t really thinking straight.”

Sepesky is hardly alone. Experts say scammers are becoming more sophisticated. They may have known Sepesky’s husband had died from online obituary announcements or her own history on social media. They targeted her when she was most vulnerable.

Federal Trade Commission data shows more than 26,000 reports of fraud in the Pittsburgh metro area in 2023. Imposter scams were most common — like the person posing as a Microsoft employee in Sepesky’s case — followed by illegitimate online shopping offers, then prize-based scams.

Nationwide, scammers siphoned a record $10 billion from consumers last year. That’s up from the $8.8 billion stolen in 2022, which, itself, was a 30% increase from 2021.

Email replaced text as the preferred way for scammers to contact potential victims last year, with phone calls coming in second.

Anyone can be a victim

It’s true that older adults lose more money to scams, according to Amy Nofziger, director of fraud victim support for AARP, but they’re not inherently gullible. Rather, they hold a majority of the nation’s wealth, making them lucrative targets for scammers.

In fact, anyone can be a victim of fraud — even if they give financial advice for a living.

Take Charlotte Cowles’ word for it. She’s the New York Magazine financial advice columnist whose article, “How I Got Scammed Out of $50,000,” went viral in February.

She’s someone who is well aware of financial scams and talks regularly to financial experts for her job. But she handed over $50,000 — in cash — to someone she had never met in an elaborate imposter scam in which the fraudsters masqueraded as U.S. government employees.

People who insist this could never happen to them should think again, says John Breyault, a fraud expert with the National Consumers League.

“No one is too smart to fall for a scam, no matter your income level or education level or age or where you live,” Breyault said. “You can be a victim of fraud.”

How to spot a scam

Experts, government agencies and frequently impersonated companies urge consumers to approach unexpected or urgent messages with skepticism.

Scammers use texts, phone calls, email and other means of communication to spin stories with stakes ranging from a missed package to a kidnapped family member.

“That is designed to get people into a heightened emotional state so they do what the fraudster wants before they take the time to investigate,” Breyault said.

Some of these messages are tailor-made for their intended victims, drawing from public information, such as company websites and social media accounts. In the workplace, this could look like a supervisor requesting an employee’s personal data from a look-alike email address.

Others are what Lorrie Cranor calls “a shot in the dark.”

Cranor, director of the Carnegie Mellon University CyLab Security and Privacy Institute, said some scammers send out thousands of generic messages. If they’re posing as a credit card company, for instance, they’re looking for recipients in legitimate credit card trouble.

All major credit card companies have tips on their websites for keeping one’s credit cards safe.

Unusual payment methods are another telltale sign of a scam. These can include peer-to-peer payments on apps such as Venmo, wire transfers or cryptocurrency — anything that’s quick, anonymous and nonrefundable.

Cranor’s rule is simple: “If you get any message through any channel that says you should transfer money or buy gift cards, it’s a scam.”

Some cyber criminals play the long game, building online relationships over months or years before turning that trust into financial gain. In these cases, watch for attempts at social isolation and manipulation, Breyault said.

In Cowles’ case, the scammers told her not to tell anyone — even her husband — about her cooperation with their “investigation.”

There are countless other scams out there, from deeply discounted merchandise that never ships to fake vacation home listings, with scammers constantly tweaking their tactics. Utility customers even report door-to-door fraudsters threatening to shut off service.

Peoples Gas, like almost all other legitimate utility providers, urges customers to ask apparent representatives for photo ID, spokesperson Nick Paradise said. Customers should independently call a utility to confirm they have employees in the neighborhood before letting anyone into their homes.

Consumers also can sign up for text alerts from the Pennsylvania Office of Attorney General that warn of scams in circulation.

By knowing the red flags, rather than memorizing a “virtually infinite” number of scams, Breyault said, consumers have the best chance at protecting their money and information.

What victims can do

Stigma makes it impossible to get a true count of the number of scam victims, experts say.

“When people are victims of fraud, there’s often shame and embarrassment that comes with it,” Breyault said. “Most fraud experts believe those numbers are a significant undercount of what the problem actually is.”

But by reporting the incident to local police, the state Attorney General’s Office or the Federal Trade Commission, victims can help to stop scammers and educate others. They also have a chance at getting their money back. Breyault emphasized police reports as an important first step to recovering lost assets.

The FTC advises consumers who have been scammed to ask their bank, credit card company, company that issued the gift card or other relevant entity to reverse the transaction. The commission notes, however, the money might already be gone.

Organizations at risk, too

A growing number of scams start on social media, up to 12% of all reports in 2023. And they often target companies and nonprofit organizations.

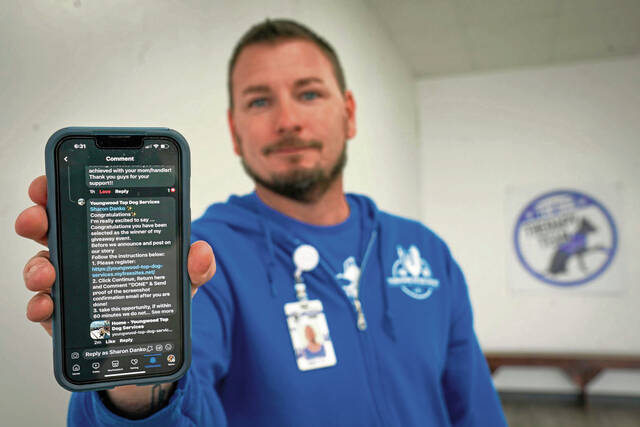

Rodney Little, president of Top Dog Therapy Team in Youngwood, sees it firsthand.

His nonprofit provides therapy dogs to schools, medical centers, grief counseling services and crisis response scenarios.

Little said scammers have targeted his nonprofit on Facebook, posting donation links to copycat websites and reselling fake tickets to their events.

Ticket sales are down 20% this year.

“It hurts us overall because people are worried — ‘Are we being scammed?’ ” Little said.

Despite reporting more than 30 malicious accounts to Facebook and blocking another 150, Little said Facebook has taken “zero action” to protect potential donors.

“I don’t think Facebook is doing enough, if anything,” he said.

Fraud losses will get worse before they get better, according to Breyault. He is pushing for federal legislation to hold payment platforms accountable for the more than 60,000 scams that happen on their watch each year.

But regulations and technology can only do so much, according to Cranor at CMU.

“A lot of this is going to rely on individuals to be vigilant and just really not believe everything that comes their way,” she said.