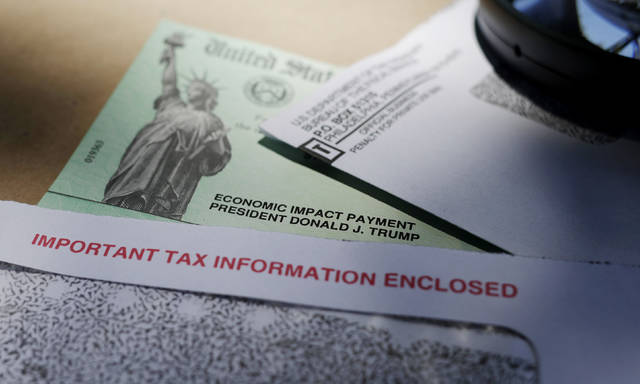

The last thing Lori Hughes expected to receive in the mail was a $1,200 stimulus check made out to her mother, Sharyn Davis, who died last July.

The 54-year-old Smithton resident is now left deciding the best course of action for sending the money back to the federal government after it was distributed as part of a $2.2 trillion economic relief package in response to the covid-19 pandemic.

“I’m happy to return it,” she said. “I just want to make sure that it’s going back to the right place.”

Reports of people receiving checks for deceased family members have been voiced for almost a month after the federal relief package offered stimulus checks to about 150 million eligible Americans based on their income from tax returns filed in 2018 and 2019.

There were no safeguards in place to stop checks from being sent to people who died since their last filing.

Now, the feds want that money back.

In a directive issued Wednesday, the IRS clarified that a person who died before receiving their stimulus payment is not eligible.

“A payment made to someone who died before receipt of the payment should be returned to the IRS by following the instructions in the Q&A about repayments,” the website reads.

What to do

According to the instructions, if someone received a paper check for a deceased person, “void” should be written in the endorsement section on the back of the check and returned to the appropriate IRS location with a note stating the reason for the returned check. For Pennsylvania residents, checks should be sent to the Philadelphia Refund Inquiry Unit.

If the payment was already cashed or received through direct deposit, a personal check or money order should be sent to the same location.

The check should be made payable to “U.S. Treasury.” The deceased’s Taxpayer Identification Number and “2020EIP” should be written on the check.

Hughes, who received the check Tuesday, has been working to find out the best way to return the money.

After unsuccessfully calling the IRS and Treasury Department, Hughes plans on asking her lawyer and bank about the best way to return the money.

On the back of the envelope containing the check, Hughes noted, there is a box that can be marked if the person the check is made out to is deceased.

“It’s just like a general address for the Department of Treasury, and I just wanted to make sure that if I did send it back it was going to get to the right person,” Hughes said.

People receiving money for deceased family members are not the only ones who need to send back stimulus checks. Payments made out someone in prison also should be returned to the IRS, according to the website.

In both cases, the spouse of the deceased person or person who is incarcerated, should keep the amount made out them specifically.

Circumstances far from 2008

This is not the first time stimulus checks have been sent to deceased people, said Nina Olsen, executive director of the Center for Taxpayer Rights.

In an interview with AARP, Olson questioned why the IRS would take a different position in 2008 when the government distributed stimulus payments. At the time, families who received money for a deceased person were not required to return the checks.

“What is the legal reasoning for this, and why is this position different from the IRS’s position in 2008?” she told AARP. “The government is entitled to change its mind, but without explaining its rationale, this position appears arbitrary and capricious.”

Forbes reported that a 2010 stimulus package issued about $18 million to deceased beneficiaries, or about 72,000 people. Checks also were made out to almost 17,350 incarcerated people.

Checks sent out at that time were a relatively smaller amount than those sent out today. In 2010, checks were $250. Today, checks range from $1,200 for a single person earning $75,000 or less, while married couples who filed jointly would receive $2,400. Each dependent gets $500.

According to Forbes, if a similar amount of deceased taxpayers received stimulus checks this year, that would amount to over $86 million.

Since the first round of checks were distributed in April, people have reported a myriad of problems, specifically those who did not have direct deposit information filed with the government from previous tax returns.

In early April, the federal government predicted those without direct deposit information could have to wait until August to receive their check.

The Associated Press reported that about 5 million people would receive paper checks per week starting May 4, meaning it could take 20 weeks to distribute all checks.

Millions of illegal immigrants who work and pay taxes also are not eligible for a check. About 4.3 million mostly unauthorized immigrants who do not have a Social Security number file taxes using what is known as a Taxpayer Identification Number, the Associated Press reported.

“I feel bad because there are so many people that are waiting for their check to come and it hasn’t come, and yet there’s so many people that are deceased that are receiving them,” Hughes said. “I feel very bad for them, and I’m hoping they get their checks soon. I know it’s frustrating for everybody.”