The start of Hampton Township School District’s fiscal year means that tax bills have been mailed to local property owners.

For the majority of them, what they owe this year is more than what they paid in 2021, primarily because of a 0.69-mill increase in the real estate tax rate as approved by the school board in conjunction with its adoption of the 2022-23 general fund budget of just under $59 million.

According to the informational packet accompanying the board’s June meeting, the gross tax for a property assessed at $171,300, the median value in Hampton, is $3,595, representing a $118 increase. In general, property owners pay $69 more for each $100,000 in assessed value.

Some good news, though: The district is receiving $1.083 million in Pennsylvania gaming revenues, up $223,128 over last year, with the money earmarked for reducing the tax bills for properties in the township that qualify for a homestead or farmstead exclusion under state law.

In Hampton, that translates to $199.09 per property, compared with $157.92 for 2021-22. The extra $41.17 effectively reduces the tax burden to a $77 increase, or 2.3%, for median-value land.

Without the homestead/farmstead consideration, the tax rate rises by 3.4%, the maximum allowed for the district as per a base index established by the state Department of Education. The index, according to the department, represents “the average of the percentage increase in the statewide average weekly wage and the (U.S.) Employment Cost Index.”

By comparison, Hampton’s projected general fund expenditures for 2022-23 are 4.2% more than last year.

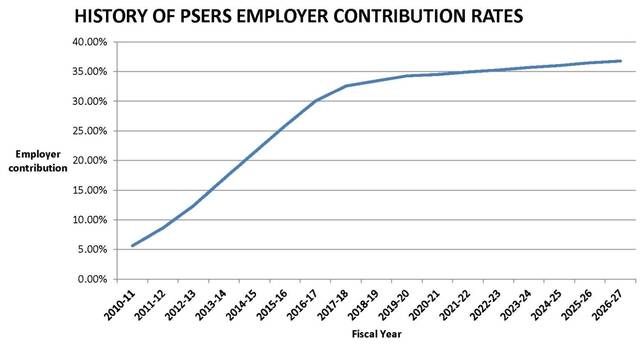

A major contributor to the increase is the district’s obligation to the Public School Employees’ Retirement System: $4.775 million, or about 8.1% of the budget. According to the board informational packet, the amount was only $610,000 for 2010-11, a year after Hampton officials took a proactive measure to address paying into the retirement system’s continuously growing unfunded liability, debt for past service already earned by members.

“The district established a PSERS Rate Stabilization Fund during the 2009-10 fiscal year,” the packet states. “The fund allocated $6.4 million toward future PSERS costs and included a formula to allocate the funds for 15 budget years.”

In 2020, the district added to the fund and renamed it simply the Stabilization Fund, and from that, $525,000 has been allocated toward matching revenues to expenditures in the 2022-23 budget.

School districts are required to make contributions to PSERS based on an actuarially calculated proportion of district payroll, which for this year was set at 35.26% across Pennsylvania.

Twenty years ago, the contribution was 1.15%. It rose from 5.64% in 2010-11 to 30.03% six years later and has remained above 30% since, with forecasts that, the board packet states, “indicate sustained rates of 35-37% for the foreseeable future.”

A 2017 University of Chicago Center for Municipal Finance analysis, “From High to Low: Understanding How the Pennsylvania Public School Employees’ Retirement System Became Underfunded,” cites action by state lawmakers in the early 2000s to reduce payments by employers while increasing pension benefits.

“While benefit increases were responsible for growth in unfunded liabilities in 2001 and 2002, they were not the primary cause of the total growth between 2000 and 2015. Instead, the two major factors that resulted in the decline of PA-PSERS’ finances were lower-than-assumed investment returns and insufficient employer contributions,” the analysis states.

“In general, the core issue is that the employer contributions required by Pennsylvanian law were not enough to prevent the unfunded liabilities from increasing from year to year.”